Borrower Benefits

Managing your money takes time and effort, but the bottom line is that you’re better off when you know where your money is coming from and where it’s going. What are the advantages of keeping a budget?

- You know where your money goes

- You know if all your expenses are covered

- You can afford the things you really want

|

Expenses |

||

|

Essential Costs |

Entertainment Costs |

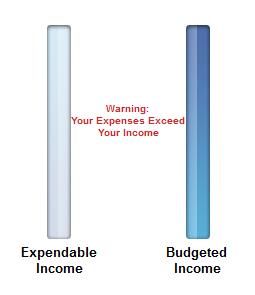

Careful that this doesn't happen to you! |

|

Food |

Movies |

|

|

Rent |

Parties |

|

|

Car |

Cell Phone |

|

|

Utilities |

|

|