IRS Data Retrieval Instructions

**Please note: For the Fall 2022, Spring 2023 and Summer 2023 semesters, you will complete the below steps on your 2022-2023 FAFSA using 2020 tax information. If you are applying for aid for the Fall 2023, Spring 2024 or Summer 2024 semesters, you will complete the steps below on your 2023-2024 FAFSA using 2021 tax information.**

The IRS Data Retrieval Tool is available for online FAFSA submittals and is accessible through the FAFSA web site https://studentaid.gov/h/apply-for-aid/fafsa. The Data Retrieval Tool allows FAFSA applicants and/or parent(s) who are eligible to transfer their tax information from the IRS to the FAFSA.

Students and/or parent(s) must actively choose to utilize the Data Retrieval Tool. If they choose to do so, they will be transferred to the Internal Revenue Service web site.

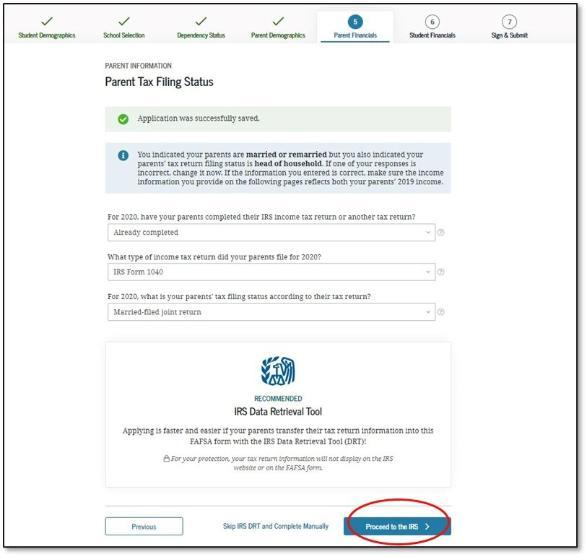

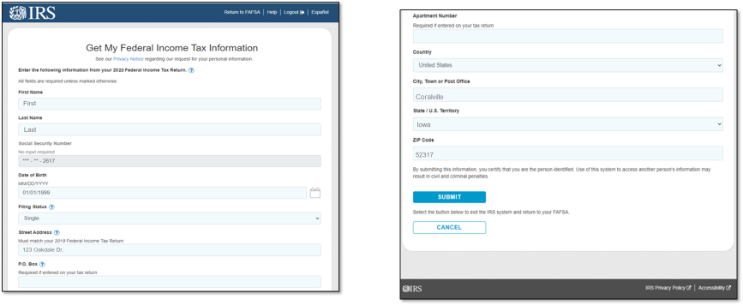

Select “Proceed to the IRS.” You and/or your parent will need to enter the FSA ID and FSA Password (if requested) and click next. You and/or your parent will be asked to confirm that you understand you and/or your parent are being transferred to the IRS web site. Students and/or parent(s) will need to authenticate their identity by entering the necessary information from the applicable federal tax return before any tax information can be transferred.

Complete the form and select 'Submit'.

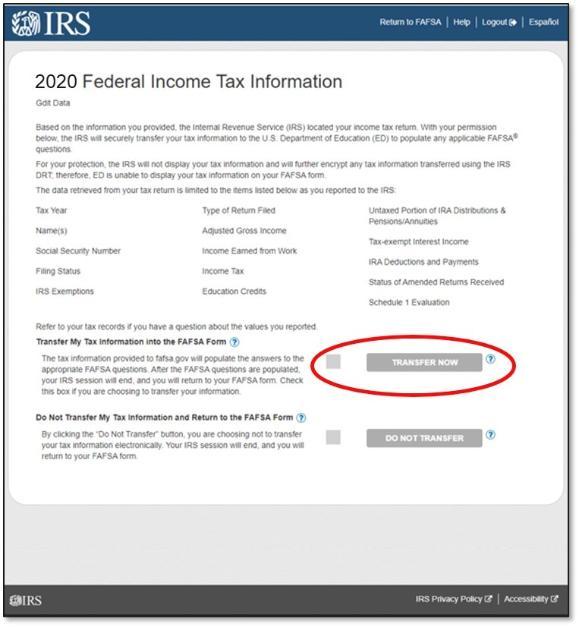

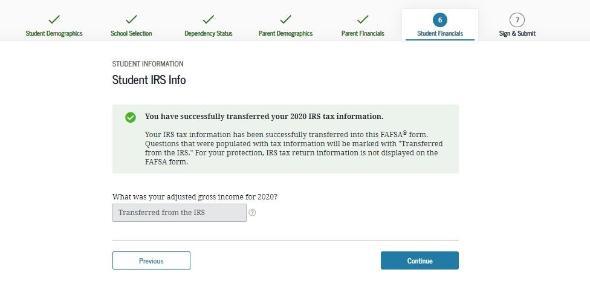

Student and/or parent(s) will have the option to “Transfer” the tax information to the FAFSA by selecting the appropriate check box and clicking the “Transfer Now” button. For the student’s and/or parent’s protection, the IRS will not display any tax information and will encrypt any tax information transferred using the IRS Data Retrieval Tool. Applicants can also choose NOT to transfer the data to the FAFSA.

Please note: In households where the student is married or in two-parent households (for dependents), income earned from working will not transfer. As a result, it is advised that families have W-2 forms and other wage/income statements readily available when filing a FAFSA.

WHEN WILL MY DATA BE AVAILABLE FROM THE IRS?

- Electronic Tax Filers - Available within 2 weeks of filing

- Paper Tax Filers - Available within 6 - 8 weeks of filing

If you plan to submit your FAFSA before you and/or your parent(s) complete and submit your federal tax return, then be sure to use the IRS Data Retrieval Tool to update your FAFSA record once the returns have been submitted and the income data is available to be retrieved.

WHO IS NOT ELIGIBLE TO USE THE TOOL?

- Married couples who file separate tax returns.

- Applicants and/or parent(s) whose marital status has changed after December 31 of the previous calendar year.

- Applicants and/or parent(s) who are neither eligible nor required to file a Federal Tax Return.

- Applicants and/or parent(s) who filed an amended tax return.

- Applicants and or/parent(s) who filed a foreign tax return.

- Applicants and/or parent(s) who recently filed their tax returns.