Instructions on IRS Tax Return Transcript

What is an IRS Tax Transcript?

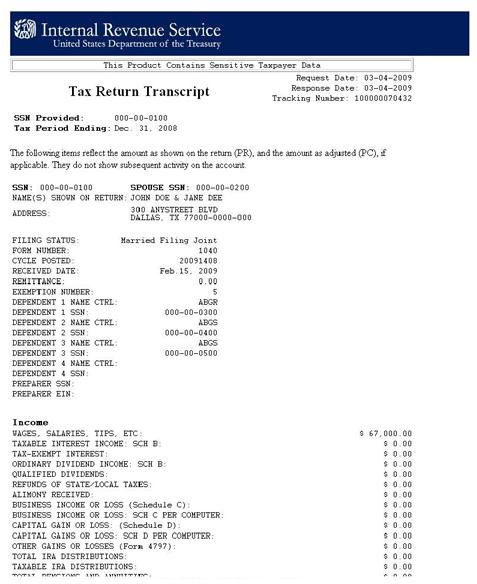

A Tax Return Transcript shows most line items from your tax return (Form 1040, 1040-SR or 1040-NR) as it was originally filed, including any accompanying forms and schedules. In most cases, your transcript includes all the information a lender or government agency needs (excluding your W-2 forms). It does not show any changes you, your representative or the Internal Revenue Service made after you filed.

How do I obtain it?

Online PDF Version:

- Visit https://www.irs.gov/individuals/get-transcript.

- Click “Get Transcript Online.”

- If you already have an account, enter username and click “Login.” Enter password and click “Submit.” If you do not have an account, click “Create Account.” Please review all required information needed to use online service before proceeding. Follow steps to create account.

- Select “Higher Education/Student Aid” as the reason you need a transcript.

- Get a transcript! BE SURE TO SELECT THE RETURN TRANSCRIPT for the applicable tax year. Our office cannot accept the Account Transcript.

- Once you have printed or saved the needed documents, sign out and close your browser.

Online Mail Request:

- Visit https://www.irs.gov/individuals/get-transcript.

- Please review all required information needed to use the online service before proceeding.

- Click “Get Transcript by Mail” and click “OK” to IRS terms of use.

- Enter all required information for taxpayer exactly as it appears on the tax return for the applicable tax year.

- Click “Continue.”

- Select RETURN TRANSCRIPT for the applicable tax year and click “continue.”

- If accepted, a tax return transcript will be mailed to the address the IRS has on file for you. Please allow five to 10 business days for receipt.

Paper Request – IRS Form 4506-T (mailed to the IRS):

- Visit IRS website for copy of 4506-T form https://www.irs.gov/pub/irs-pdf/f4506t.pdf.

- Complete all sections, as applicable. Do NOT request the transcript be sent to a third party. You must have the transcript mailed directly to the taxpayer.

- Complete Line 6 with the applicable tax year and check RETURN TRANSCRIPT.

- Sign, date, and mail or fax the form to the appropriate address on Page 2 of the form.

PLEASE NOTE:

If obtaining a tax return transcript for the 2024-2025 FAFSA (Fall 2024, Spring 2024 or Summer 2025 semesters), you must request a copy of your 2022 tax transcript.

You MUST include your (student’s) name and CCU ID number on all documents submitted to our office. Failure to do so will result in a delay of the processing of your documents.